Where Accountants Go

The Accounting Careers Podcast

243: Mansour Farhat – Continuing To Make Life Easier for Accounting Students

Professor Mansour Farhat, a previous guest on our show, came back for this episode of Where Accountants Go to tell us about a new offering he has helped make available for accounting students. If you weren’t already aware of Mansour from his 1900+ Youtube videos on...

242: Hitendra Patil – Becoming An Accountaneur ™

Hitendra Patil of AccountantsWorld, who also frequently appears on the list of the Top 100 Most Influential People In Accounting, joined us for this episode of Where Accountants Go, the Accounting Careers Podcast. We like to cover a variety of career topics for...

241: Lee Frederiksen – Discussing The Great Resignation

Lee Frederiksen of Hinge joined us for this week’s episode of Where Accountants Go, the Accounting Careers Podcast. Lee’s team approached us with this topic, and we were very excited to have the discussion. “The Great Resignation” is a phenomenon affecting the entire...

240: Jennifer Todling – “You Can Be Whatever Kind Of Partner You Want To Be”

Jennifer Todling, Partner with EY, joined us for this episode of Where Accountants Go, the Accounting Careers Podcast. When we scheduled this episode, we knew it was going to be a story of a successful, progressive accounting career as Jennifer had been with EY...

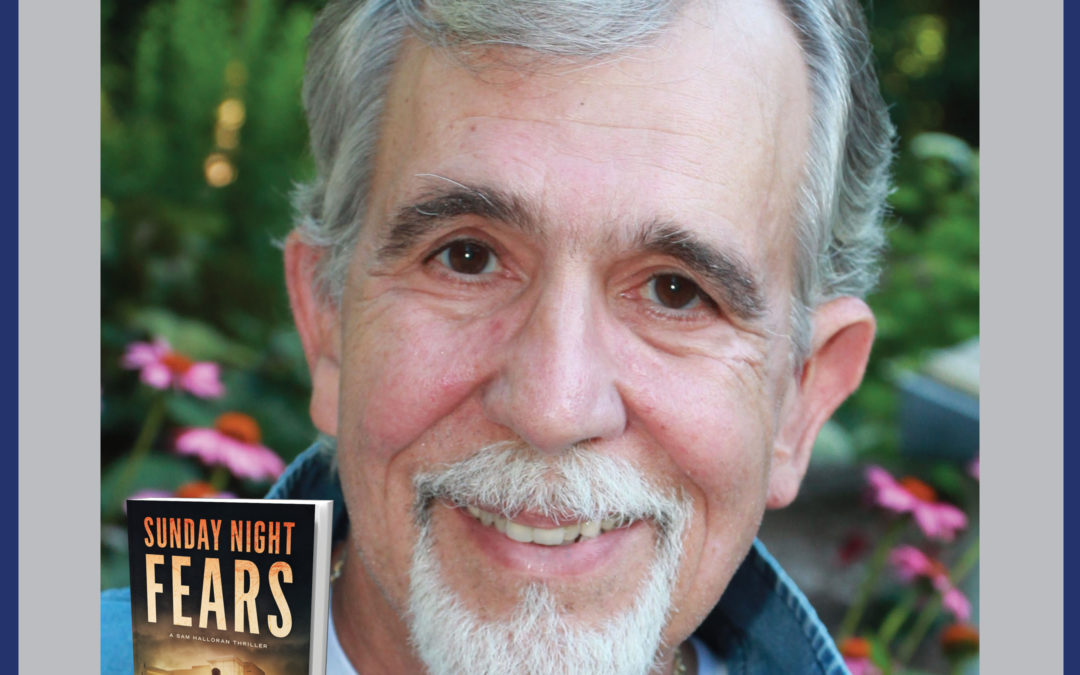

239: Tom Golden – Retired Forensics Partner and Author of Sunday Night Fears

Tom Golden, a retired forensics partner from PwC (PriceWaterhouseCoopers), who also has authored two forensics thrillers, joined us for this episode of Where Accountants Go, the Accounting Careers Podcast. If you have ever wondered about the realities of investigating...

238: Jason Parr of Peisner Johnson – From Assistant to President!

Jason Parr, the President of Peisner Johnson, a state and local tax consulting company, joined us this week for Where Accountants Go, the Accounting Careers Podcast. In this episode, we discuss the road less traveled so-to-speak with respect to careers… that of...

237: Alicia Maples – Build Your Wealth By Firing Your Clients

Alicia Maples, a professional business coach that I personally have worked with for many years, joined us for this episode of Where Accountants Go, The Accounting Careers Podcast. In this special edition episode, we have a very direct and practical conversation about...

236: Andrew Jordan – COO of FinancePal

Andrew Jordan, CPA and COO of FinancePal, joined us for this episode of Where Accountants Go, the Accounting Careers Podcast. We touch on many topics in this particular show, from finding the right career fit for your own needs, all the way to starting and merging a...